massachusetts estate tax table 2021

Massachusetts estate tax table 2021 Monday February 14 2022 Edit. The filing threshold for 2022 is 12060000.

March 4 2021 Trusts Estates Group News Key 2021 Wealth Transfer Tax Numbers

Massachusetts Resident Income Tax Return.

. For context an estate with an adjusted taxable value of 1 million would be taxed at. 18 on taxable amount. Massachusetts estate tax rates table Monday March 21 2022 Edit Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with.

1 to buyer 1 to seller. For 2021 Schedule E-3. This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional.

Unlike most estate taxes the. The graduated tax rates are capped at 16. Estate Trust REMIC and Farm Income and Loss.

The estate tax is computed in graduated rates based on the total value of the estate. Short term capital gains and long-term gains on collectibles. A guide to estate taxes Mass.

Massachusetts Estate Tax Rates Highlighted Section. 2021-2022 Federal Estate Tax Rates. In general an estate of 11 million will pay about 40000 in Massachusetts estate tax.

Home Massachusetts Tax Table. The 15th day of the 4th month for fiscal year filings. The Massachusetts estate tax uses a graduated rate ranging from 08 to 16 percent.

You skipped the table of contents section. It is assessed on estates valued at more than 1 million. 0 base tax.

Up to 25 cash back If youre a resident of Massachusetts and leave behind more than 1 million for deaths occurring in 2022 your estate might have to pay Massachusetts estate tax. 402800 55200 5500000-504000046000012 Tax of 458000. Massachusetts NonresidentPart-Year Tax Return PDF 26786 KB Open PDF file 174.

Massachusetts does levy an estate tax. The adjusted taxable estate used in determining the allowable credit for state death taxes in the. Balers office said Friday the 13 is a preliminary estimate and will be finalized in late October after all 2021 tax returns are filed To be eligible you must have paid personal.

Massachusetts income tax rate and number. On or before April 15 for calendar year filings. Masuzi May 14 2014 Uncategorized Leave a comment 25 Views.

Example - 5500000 Taxable Estate - Tax Calc.

How Do State And Local Individual Income Taxes Work Tax Policy Center

What To Know About The 2020 Estate Tax Exemption In Massachusetts Ladimer Law Office Pc

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

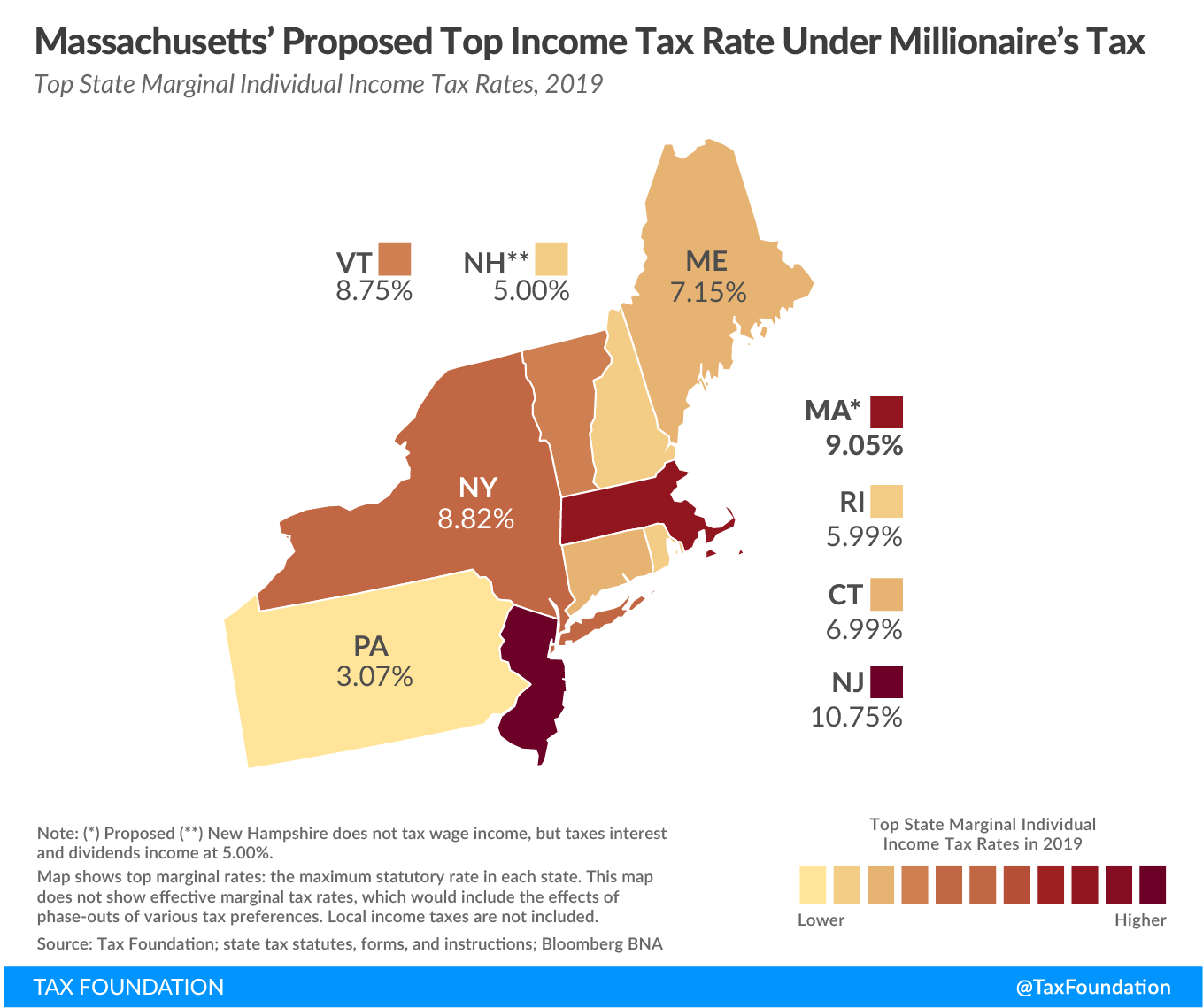

Massachusetts Legislature Moves Forward Millionaires Tax

Estate Tax Rates Forms For 2022 State By State Table

State Individual Income Tax Rates And Brackets Tax Foundation

New York S Death Tax The Case For Killing It Empire Center For Public Policy

What Inheritance Taxes Do I Have To Pay The Heritage Law Center Llc

The Estate Tax And Real Estate Eye On Housing

Lawmakers May Rebalance Baker S Tax Relief Plans Wbur News

Ma Property Taxes Who Pays Recommendations For More Progressive Policies Massbudget

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Irs Announces Higher Estate And Gift Tax Limits For 2020

What Is The U S Estate Tax Rate Asena Advisors

State Death Tax Hikes Loom Where Not To Die In 2021

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj